washington county utah sales tax

Washington County Administration Building 197 East Tabernacle St George Utah Google Maps Auctions will be by open bidding wherein the full. The County Assessor is responsible for listing and valuing all taxable real and personal property in Washington County.

Dixie State Gets Final Approval From Utah Lawmakers To Drop Contentious Name

Property Tax Estimate NOTE.

. Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01. The most populous zip code in. Washington County UT Sales Tax Rate The current total local sales tax rate in Washington County UT is 6450.

Or the local number for the Utah State Tax Commission is 435 251-9520. This is the total of state and county sales tax rates. 93 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The Washington County Treasurers office is pleased to offer a range of helpful information for the. The minimum combined 2022 sales tax rate for Washington County Utah is. See corporationsutahgov for more information.

6964 Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. There are many different tax relief programs available for Washington County primary property owners. The December 2020 total local sales tax rate was also 6450.

Please update your bookmarks accordingly. The Washington County Sales Tax is 16 A county-wide sales tax rate of 16 is applicable to localities in Washington County in addition to the 485 Utah sales tax. There are a total of 125 local tax jurisdictions across the state.

Sales Tax Number if items are sold. Consolidated Washington County Utah tax sale information to make your research quick easy and convenient. The Washington County Utah sales tax is 605 consisting of 470 Utah state sales tax and 135 Washington County local sales taxesThe local sales tax consists of a 135 county.

The minimum combined 2022 sales tax rate for Washington Utah is. 87 North 200 East STE 201. While many other states allow counties and other localities to collect a local option sales tax Utah does not.

Washington UT Sales Tax Rate The current total local sales tax rate in Washington UT is 6750. The December 2020 total local sales tax rate was also 6750. What is the sales tax rate in Washington County.

Provide copy of your Utah. This webpage has been moved here. As far as all cities towns and locations go the place with the highest sales tax rate is Springdale and the place with the lowest sales tax rate is Central.

The Washington Utah sales tax is 595 the same as the Utah state sales tax. This sale will be located in. State Local Option Mass Transit Rural Hospital.

What is the sales tax rate in Washington Utah. Some cities and local. 145 lower than the maximum sales tax in UT The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035 Washington County sales tax 1 Washington tax and.

Assessor Tom Durrant 87 North 200 East STE 201 St. This is the total of state county and city sales tax rates.

Water District Eyes Tax Hike As S Utah Saves For Lake Powell Pipeline

Washington County Md Washington County

Washington County Of Utah County News At Your Fingertips

General Sales Taxes And Gross Receipts Taxes Urban Institute

Utah Sales Tax Small Business Guide Truic

Business Guide To Sales Tax In Utah

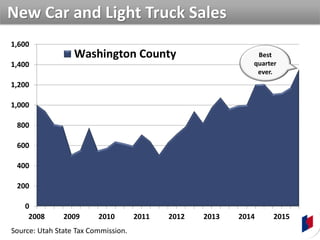

What S Up With The Washington County Economy

State Lodging Tax Requirements

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

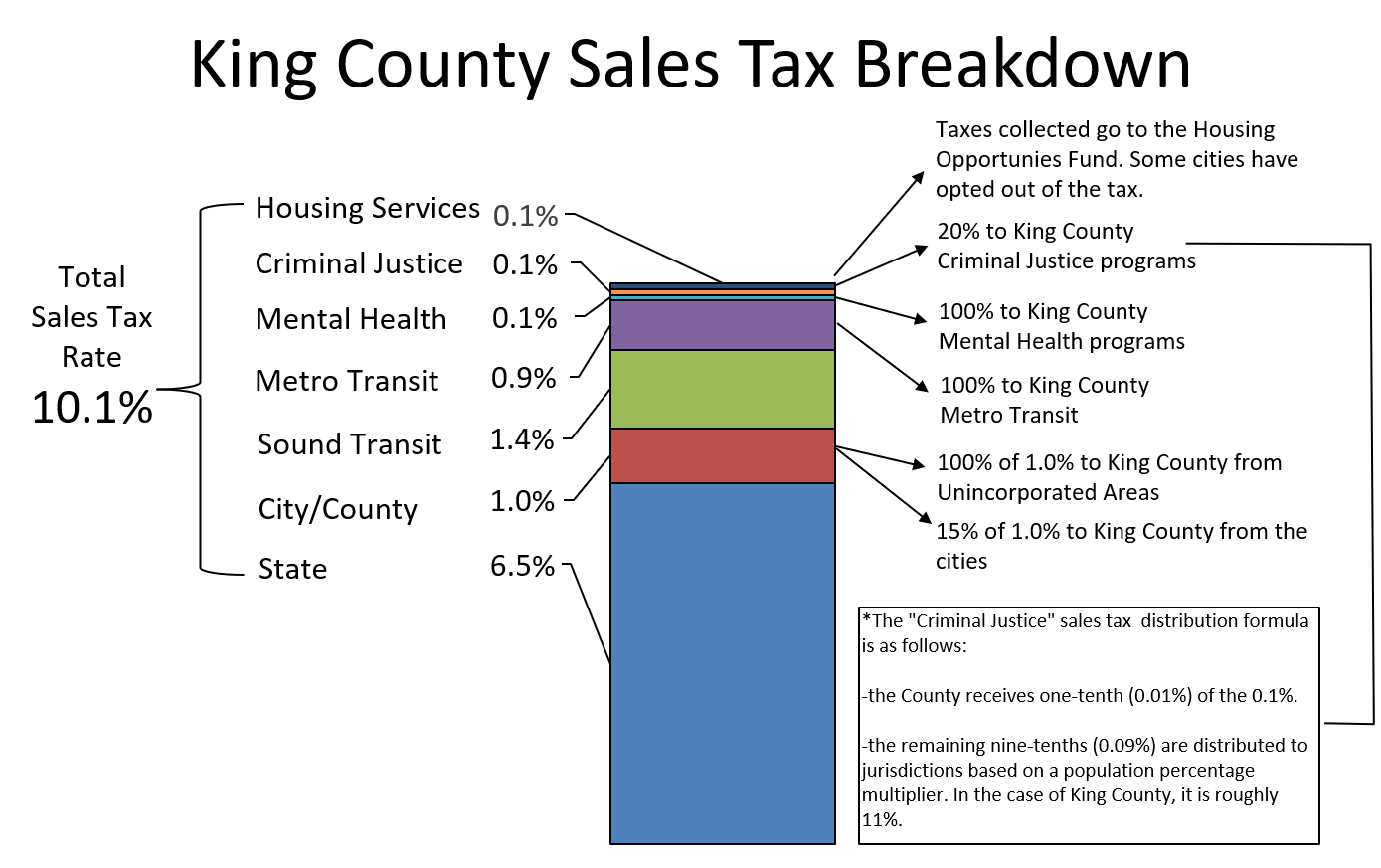

King County Sales Tax King County

Lake Powell Pipeline Utah Rivers Council

Washington County Sees 75 Spike In Tourism Revenue What This Means For Greater Zion St George News

Utah Sales Tax Rate Rates Calculator Avalara

Sales Tax Amnesty Programs By State Sales Tax Institute

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Utah America S Thirstiest State Wrestles With Unmetered Water Water Deeply