tax lien nj foreclosure

The Sheriffs Office sends any surplus funds to the New Jersey State Superior Court co Trust Fund Unit after the purchaser has paid the balance of the purchase price fees are deducted and all financial transactions are finalized. This is a preliminary step to selling the property at public auction for satisfaction of the tax lien.

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

The judgment is docketed 30 days after the property owner is notified either by certified mail or publication.

. The Wake County Department of Tax Administration dockets foreclosure judgments with the court system for unpaid property taxes on real estate. This means that the funds are not readily available immediately following the sale as there are instances when the Trust Fund Unit may not.

Can I Sell My House A Tax Liens Tax Lien On A Home

Nj Title Insurance And Personam Tax Foreclosures

Understanding Nj Tax Lien Foreclosure Westmarq

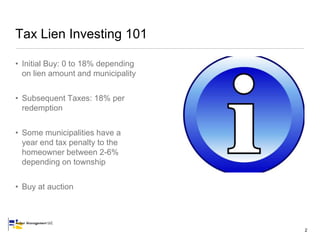

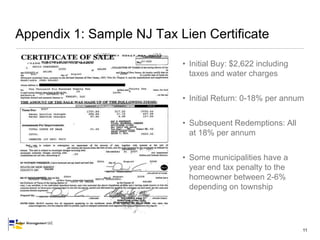

How To Buy Tax Liens In New Jersey

How To Buy Tax Liens In New Jersey

How To Buy Tax Liens In New Jersey

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

What Happens When Your House Goes Up For Auction Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Nj Tax Lien Foreclosure Attorneys

Tax Sale Tutorial New Jersey Florida Tax Lien Deed Research Youtube

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

New Jersey Foreclosure Law Practice

Understanding Nj Tax Lien Foreclosure Westmarq

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

If A Tax Deed Investor After Winning The Tax Deed Refuses To Pay For The Previous Owner S Unpaid Mortgage Then What Will Happen To That Investor Quora

Circuit Split On Avoidance Of Tax Foreclosure Sales Will Supreme Court Settle The Issue New Jersey Law Journal